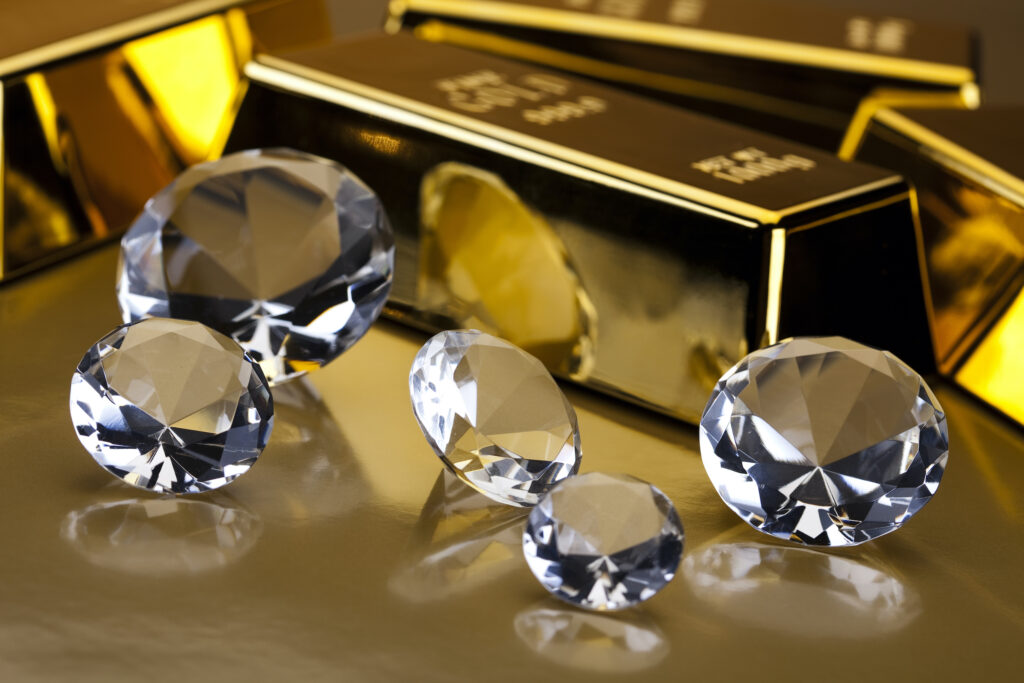

Why do Banks Offer Loans Against Gold But Not Against Diamonds?

When it comes to securing a loan, borrowers have a variety of options to choose from. One of the most popular ways to secure a loan is by offering gold as collateral. However, the practice of offering diamonds as collateral for a loan is relatively uncommon. In this article, we will explore the reasons why banks prefer to offer loans against gold rather than diamonds.

First, gold is a more liquid asset than diamonds. This means that it is easier to buy and sell gold, and the market for gold is more stable. Banks prefer to lend against assets that are easy to sell in case the borrower defaults on the loan.

Second, gold is a universally recognized store of value. It has been used as a form of currency and a store of wealth for thousands of years. Diamonds, on the other hand, are not as widely accepted as a store of value. This makes it more difficult for banks to assess the value of a diamond and offer a loan against it.

Third, gold is a tangible asset, meaning it has a physical form that can be easily inspected and appraised. On the other hand, diamonds are often difficult to authenticate and appraise. This makes it harder for banks to determine the value of a diamond and offer a loan against it. With technology, artificial diamonds are being created in labs, that mimic the properties of the real diamond, causing more complexities in authenticating and appraising a diamond.

Fourth, the diamond market is highly speculative and the prices fluctuate wildly. Banks prefer to lend against assets that are stable in value, so they are less likely to suffer losses in case of default.

Lastly, the diamond market is more opaque than the gold market, making it harder to track the movement of diamonds and their prices, which again makes it more difficult for banks to offer loans against diamonds.

In conclusion, while banks do offer loans against diamonds, they prefer to offer loans against gold due to its liquidity, stability, and universally recognized store of value. Additionally, the diamond market is highly speculative, difficult to authenticate and appraise, and opaque which makes it harder for banks to offer loans against diamonds.